Unknown Mystery Of Taj Mahal | Shah Jahan & Mumtaz Love Story

Mystery Of Taj Mahal: When we see the most beautiful person around us we fall in love with them within…

30 Interesting Facts About Love Psychology Crazy Love Facts To Warm Your Heart

Today Let us know more about Interesting facts about love psychology. Love is undoubtedly a sweet feeling anyone can have.…

Top 9 Hidden Treasures in India You Must Know

These 9 hidden Treasures in India are not only about Money and Gold as you think but only 1% is…

Top 10 Valentine’s Day Gifts for Him in 2022

It is always convenient to get gifts for ladies on all kinds of occasions, but in the case of males,…

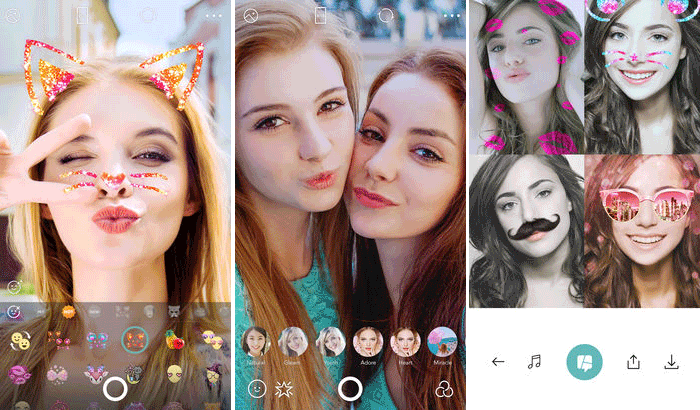

Top 10 best selfie apps for iPhone in 2022

Selfie Apps With the growth of social media applications, people are more likely to post their everyday pictures and selfies…

Top 10 Most Beautiful Women in the World 2022

Beautiful women, Beauty is studied as a part of aesthetics, culture, and many other things. It is the combination of…

List of 10 Best Coupon Submission Websites in 2022

Mayhap many of you would be aware of the name of coupon submission websites and their benefits. Typically, coupon submission…

Top 10 Best Toothpaste Brands in India 2022

Choosing the right toothpaste brand for fresh breath, people always try to get the best option for their hygiene. Brushing…

Top 10 Richest Actresses in the World

Entertainment industries especially Hollywood, is snowballing because of latest technologies used for producing movies and TV shows. People are more…

Top 10 Most Expensive Bikes in the World of 2022

Top 10 Most Expensive Bikes in the World: The World’s top vehicle brands are introducing the fully featured bikes to…

Top 10 Best Toothpaste Brands in the World of 2022

Toothpaste is a gel related to a toothbrush to help clean and keep up the feel and soundness of teeth.…

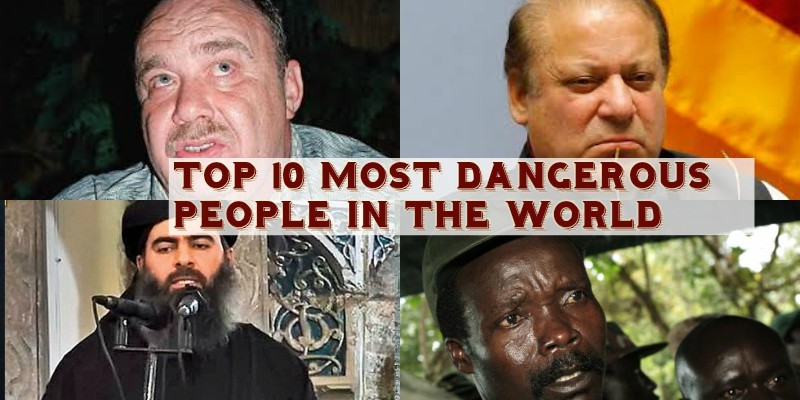

Top 10 Most Dangerous People in the World of 2022

The word danger does not only mean accidents or natural disasters. It is something beyond this, there is no shortage…

Top 10 Largest Shopping Malls in the World of 2022

The largest shopping malls can be defined as the stores having the best facilities for the customers. Due to the…

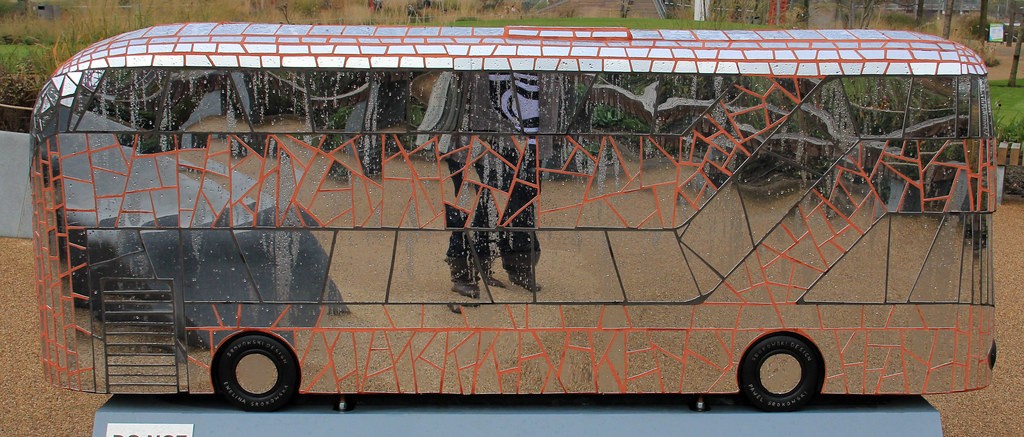

Top 10 List of Largest Buses in the World of 2022

With the growth of the population, technology starts to bring new changes to people’s lives. Modes of transport are also…

Top 10 Most Handsome Cricketers of the World

Handsome cricketers: As you all know that looks matter these days. There are many sports which are being played and…

Why Scotland Is An Unforgettable Vacation Destination

When planning your next vacation, Scotland stands out as an enchanting destination that offers a perfect blend of rich history,…

The Ultimate Guide To Surprising A Led Zeppelin Fan on Their Birthday

Suppose you have a friend or loved one who is a die-hard Led Zeppelin fan. In that case, their birthday…

7 Tips to Make a Diamond Seem Bigger

You want as much sparkle as possible when shopping for an engagement ring. Buying a diamond engagement ring can be…

Savouring Italy: 10 Iconic Italian Dishes You Can’t-Miss

Italy – a land of rich history, stunning landscape, and of course, mouthwatering cuisine. When it comes to Italian food,…

Unwind and Rejuvenate: How Massage Can Improve Your Well-being

Picture this: you’ve had a long and tiring day at work, and all you want is some peace and relaxation.…

Why Private Pregnancy Care Is Worth Considering

Congratulations! You’re expecting a baby, and it’s an exciting time, filled with joy and anticipation. As you go on this…

What Are the Top Advantages of Living in a Care Home?

As people get older, they will begin to think about what life will look like post-retirement. There are plenty of…

How to Choose the Right Care Home: A Step-by-Step Guide for Families

Making the decision to move a loved one into a care home can be a challenging and emotional process for…

7 Key Factors to Consider When Selecting Furniture for Your Space

Choosing the perfect furniture for your space/home can be an exciting and fulfilling experience. It’s a chance to showcase your…